For a country that imports over 70 per cent of its annual crude oil needs and remitted about Rs 1,17,000 crore* in 2004-05, the use of ethanol blend has not got the importance that it deserves. The government plans to make 5 per cent blend mandatory for all states by the next sugar season, that is, 2006-07. Further blending at 10 per cent is to be achieved across the country in the next two years. Grand plans!

Five per cent ethanol blending was made effective from January 2003 in nine states and four Union territories. Against plan, petrol ethanol blend is being supplied in the four states of UP, Punjab, Karnataka and Tamil Nadu (nine districts). In Maharashtra, Goa, Gujarat, Andhra Pradesh and Uttaranchal, oil marketing companies (OMCs) are in the process of finalising tenders for purchase of ethanol. No progress has been made in Haryana and the four Union territories.

OMCs could blame sugar companies for non-availability of ethanol. Conversely, sugar companies could attribute it to the 21 per cent drop in sugarcane production between 2001-02 and 2004-05 or blame OMCs for not lifting stocks/delayed payment, (According to Jyoti Parikh, Business Standard, February 27 2006, OMCs have not lifted 475 million litres of ethanol).

Who is responsible for this delay, where does the buck stop, what is the way forward? But first, why is use of Ethanol so Before the next round, the government needs to cap the windfall profits coming out of global prices shooting up.

The New Oil Exploration Policy (NELP) was started in January 1999 when the price of Brent crude was around $18 a barrel, our domestic production around 32 million tonnes a year, and our foreign exchange reserves $30 billion. The corresponding figures today are $79, 32 million tonnes and $210 billion. Is that reason enough to revisit the NELP?

Between the first and the sixth rounds of the NELP, the government has offered around 50 blocks for exploration and production (E&P), while the number of bids has trebled from 45 in NELP-1 to 162 in NELP-6, a result of the aggressive marketing by the Directorate General of Hydrocarbons (DGH), disclosure of the estimated production profile of the blocks being offered, and the changing perception of India’s attractiveness as a hydrocarbon reservoir. Once the blocks are awarded, the government and the winning E&P firm enter into a production sharing agreement.

The bids are/were evaluated on the technical and financial capability of the firms, their work programme (number of wells to be drilled and the area to be explored) and the revenue (profit petroleum, in jargon) they will share with the government — the revenue share is assigned the highest weight. Various combinations of prices and production profiles are assumed while evaluating the bid, the NPVs of each are calculated and a weighted average used to decide which E&P’s bid offers the government the highest profits.

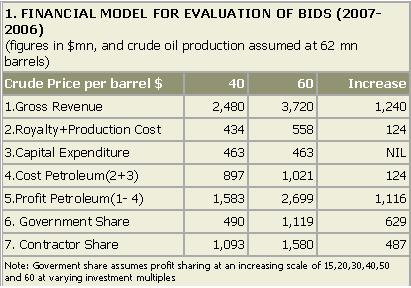

Using assumed numbers, of production, crude prices and even profit petroleum, Table 1 explains how this works. If an E&P firm produces 62 million barrels of crude and the global price is $40, the government gets a profit of $490 million while the private firm gets $1,093 million. If, however, global oil prices now rise to $60, the E&P firm now gets a windfall profit of $487 million. When the NELP began, crude prices were $18; they’re over $75 today. So, the E&P’s need to do precious little to see their profits jump manifold.

The government’s share of profits is typically bid in relation to what’s called the ‘investment multiple’ (IM) — this is the net cash income divide by capex or simply how many times the E&P’s earnings are when compared to investment. Net cash income is cost petroleum plus contractor’s share of profit petroleum less royalty and production cost.

In a nutshell, any change in crude oil prices, capex or profit shares affects the investment multiple. For each investment multiple band (starting with less than 1.5 and going up to more than 3.5), E&P firms state what profit share they are willing to share with the government. In the table, if the IM is less than 1.5, the government gets 15 per cent of the profits; when it rises to more than 3.5, the government gets 60 per cent — this is called a rising scale.

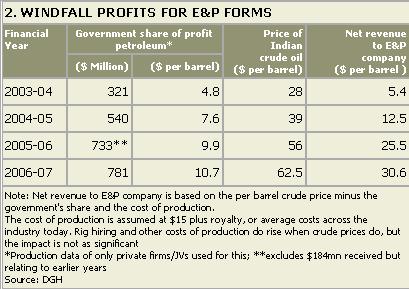

Since Table 1 is only a theoretical framework to explain how the profit shares are arrived at, it’s a good idea to see what really happened between 2003-04 and 2006-07. As can be seen from Table 2, the share that accrued to the government remained constant at around 17 per cent while that for E&P firms rose from 19 per cent to 49 per cent, thanks primarily to rising global crude oil prices.

Till NELP-5, all bidders offered a rising share of profit sharing. In NELP-6, however, to quote V K Sibal, the Director General of the DGH, “Out of 52 blocks awarded in NELP 6, 28 successful bidders offered a rising scale of profit sharing, five offered zigzag scale, two offered flat scale and 17 offered a falling scale of profit sharing”. Back-of-the-envelope calculations indicate that a falling scale of profit sharing might have a material impact on government revenues, and this gets worse when crude prices are rising.

Sibal adds, “A falling scale of profit sharing does not necessarily mean that the government share will fall due to the fact that in most of the small and less prospective blocks, the profit petroleum is not likely to touch the higher tranches of the investment multiple even at higher crude and gas prices. It is for this reason that the bidders who bid a falling scale of profit share still managed to score a higher NPV of government share of profit petroleum”.

The problem, however, is that the DGH refuses to give the production profiles of the blocks that have been awarded based on a fall in the government share with each increase in the investment multiple — if the blocks have large production profiles, the loss of government revenues could be significant.

One argument made in favor of retaining the present system even in NELP-7 is that the government’s main objective is to increase domestic oil production, and this helps achieve that. Also, when steel prices rise, say, and steel firms earn windfall gains, they don’t pay the government a higher proportion of taxes. On the other hand, it’s useful to keep in mind that Article 297 of the Constitution categorically says the ownership of “things of value within territorial waters or continental shelf and resources of the exclusive economic zone to vest in the Union”.

There is no case for doing what other countries have done after oil prices began sky-rocketing — Bolivia increased royalties, President Chavez handed control of Venezuela’s oil operations to state-owned Petroleos de Venezuela SA, Ecuador took over Occidental Petroleum’s operation and revoked its contract, and Russia renationalised oil fields. But surely there is no case for handing over super-normal profits to firms? In any case, there is no analysis anywhere to show E&P firms would not aggressively bid for oil/gas blocks if the government was to take away the windfall profits.

While revisiting the NELP, the government needs to answer a fundamental question. What is the purpose of NELP? To increase domestic production at any cost or increase both production and revenue? India’s options could be:

• The revenue from an increase in crude prices beyond a peak price should accrue wholly to the government. The peak price assumed in NELP-6 was $50 per barrel. Of course, if oil prices fall below a certain level, say $30, the government should pay the E&P firm or reduce its own profit share.

• Since capex has an impact on IM/profit sharing; any increase in this must be approved by an external consultant and the sector regulator. Since the NELP generates significant revenues, the finance minister should be a party to deliberations.

In the interests of the country, the matter needs to be publicly debated with all the facts out in the open. Today, apart from a few people in the offices of the DGH and the oil companies (all of whom refuse to give out anything but the barest of details); no one understands the intricacies of profit sharing between the government and the oil companies.

The author is CEO of Surya Consulting.